Hacking Budgets & Burn Rate for High-Growth Startups

Balancing burn rate and runway is easily one of the most crucial responsibilities of a startup. Typically, the CEO in collaboration with the C-suite keeps a finger on the pulse of the fast-paced spend. That’s typical with high growth companies. In rarer instances, startups with proper finance and operations personnel lean on them.

Startups operating at a loss is seen as a necessary yet gruelling step to profitability, and we’re not here to refute that. But how fast you can become cash-flow positive varies from startup to startup. There are some commonalities and best practices that are prominent across most startup success stories. Here’s how you can hack your budgets and get a grip on your burn rate.

Start with Sales and Marketing

Most B2B startups are inherently sales-driven, and most B2C startups are more marketing oriented. This is a product of how they find they find their prospective customers. While it’s not a catch-all, it narrows down your starting place for budgets and spend management. You’ll either need a direct initial investment in salespeople, calling on new clients directly as a cornerstone of your revenue strategy. Or you’ll need to allocate those funds to digital marketing and media buys to attract prospects and pipeline. Of course, a combination and balance of the two are key. But depending on your product or service, it will likely be weighted heavily towards one of the two.

For industry-specific B2B companies, leads didn’t just come through the door. It took some showing and proving for potential leads to buy-in. That comes with real strategy and creative thinking. Travel, trade-shows and networking is a core tenant of strategy for Innovapptive’s team. They needed a flexible solution to account for dollars and personnel constantly on the move. Not knowing what to expect, Gloria and her team jumped into a far from familiar transition.

“Procurify is our first PO system. We had people all over the world spending money but we didn’t have plans to budget or forecast. That makes things extremely difficult when you get an invoice out of the blue,” she admitted. Most of what Gloria and her team routes through Procurify is marketing spend. It’s now allowing them to move quickly and slash through sales targets and relevant KPIs.Not long ago Gloria and her team had no formal budgeting process in place. They had to deal with unexpected invoices from rogue spending as well as major purchasing bottlenecks. Now, Gloria’s going back to focusing on equipping her team and keeping them prepared for unforeseen events.

Not Getting Burned

Software companies are often pressured by investors to spend money in a certain window of time to capitalize on growth and market opportunity. Burn rates also account for the main reason why two-thirds of startups self-destruct. It’s important to understand the different kinds of burn rate to take control of them:

First up, Net burn rate is calculated as the net cash spend per month or cash inflows and cash outflows that occur when running your business.

Then there’s Gross burn rate which describes only the cash outflows per month.

To optimize burn rate and keep a healthy level of runway, you need to implement some key habits early. Firstly, rent, lease and contract as much as you can in early stages. Building frameworks and keeping major salaries off your books for inessential tasks goes a long way for startups. Especially when they are early in their lifecycle. This will make for additional flexibility to cut costs or increase production during crucial stages.

Secondly, take a beachhead approach to your market strategy and stay within the boundaries of your growth stage. Attempting to do too much too fast is a surefire way to deplete your reserves and burn through your runway. This brings us to our final point: maintain a level of transparency and collaboration with your investors. Burn rate is something investors are keeping tabs on. Rather than becoming obsessed and paranoid about spending money too fast, you should be able to justify investments and tie them directly to ROI.

Spending money to make that big hire for your product team likely won’t be a decision that is contested at a growth stage. It might end up being an integral piece for your culture and product roadmap that can accelerate your scale and ultimately, your revenue. Keeping investors excited about spend will only make them more confident in your team’s ability to lead and make tough decisions. This reduces the risk of your company being added to the current burn rate graveyard that swallows a huge majority of startups around the globe.

Expenses

It’s crucial to organize expenses for your entire organization to have visibility into what you’re spending. This enables for more accurate forecasting, your true gross margins and cost per acquisition.

There are plenty of startups that get expenses wrong, and they normally pay for it retroactively. Often, they’ll pay more later down the line to hire a bookkeeper for a total upheaval of their books.

Rather than tracking expenses in a spreadsheet and a basic accounting platform, investing in a spend management solution is the gift that will give back for the entirety of your company’s growth stage. SoFar Sounds is a high growth company with international events in live music events. With workers constantly in remote locations and different time zones, invoices and expenses were an impossible task.

Prior to Procurify, So Far Sounds had no software for invoices – just a standard accounting system and a spreadsheet for budgets. “For project management, uploading invoices took up to an hour. Then we marked them manually and paid them out. You can imagine how much quicker things are now.” says Clare Goodwin, Finance Manager of So Far Sounds.

“Now, things are ordered, and once the show has taken place, they will receive the item and the invoice attached to that. I extract those invoices and put them into our accounting system through the payment side. Artists want to receive payment as quickly as possible. We work really hard on compensating them as efficiently as possible.”

Utilizing Real-Time Budgets

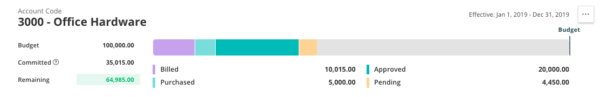

Finally, real-time budgets are a necessity to make expenses and forecasting a strength for your organization. You can set up Procurify’s Budget tracking module to allows a team to track their spend throughout its journey. It allows greater insight into how fast your spending takes before it reaches your Accounts Payable teams. Now, they can foresee these costs before an invoice is even received.

Not only does this slice your budget in the stages of pending, approved and purchased, it also updates in real time when you make changes to purchase orders in the platform to update automatically. Giving the relevant stakeholders in your startup this level of access and granularity is a massive leg up when it comes to forecasting quarters ahead and keeping track of runway.

Monthly reviews on your budget forecasts against the actual expenditures is the next key step that provides the opportunity to tweak as you move in parallel with revenue and burn rate, and prevents incurring unnecessary expenses and mistakes that are detrimental to saving and achieving objectives. Regularly reviewing the budget with key stakeholders is more than a recurring meeting, it’s a cost efficiency effort to increase savings by preventing nonessential items from creeping into expenditures.