Supplier onboarding shouldn’t be where everything stalls. This article breaks down the most common friction points and shows how teams are making the process faster, cleaner, and easier to manage.

Supplier onboarding shouldn’t be where everything stalls. This article breaks down the most common friction points and shows how teams are making the process faster, cleaner, and easier to manage.

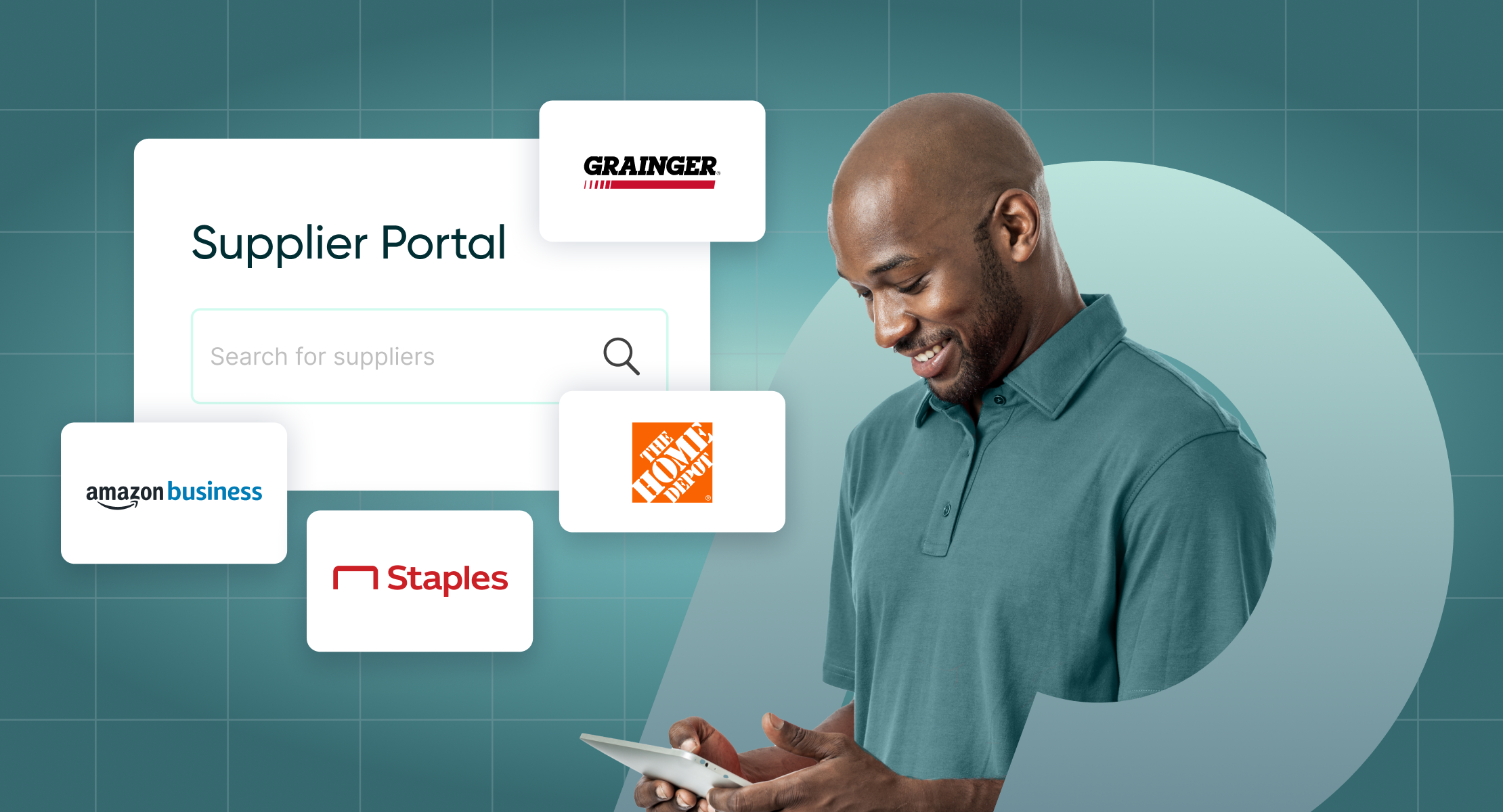

How does your organization compare? Our 2025 report breaks down $20B in spend data to reveal where top-performing procurement teams are getting it right—and where others fall short.

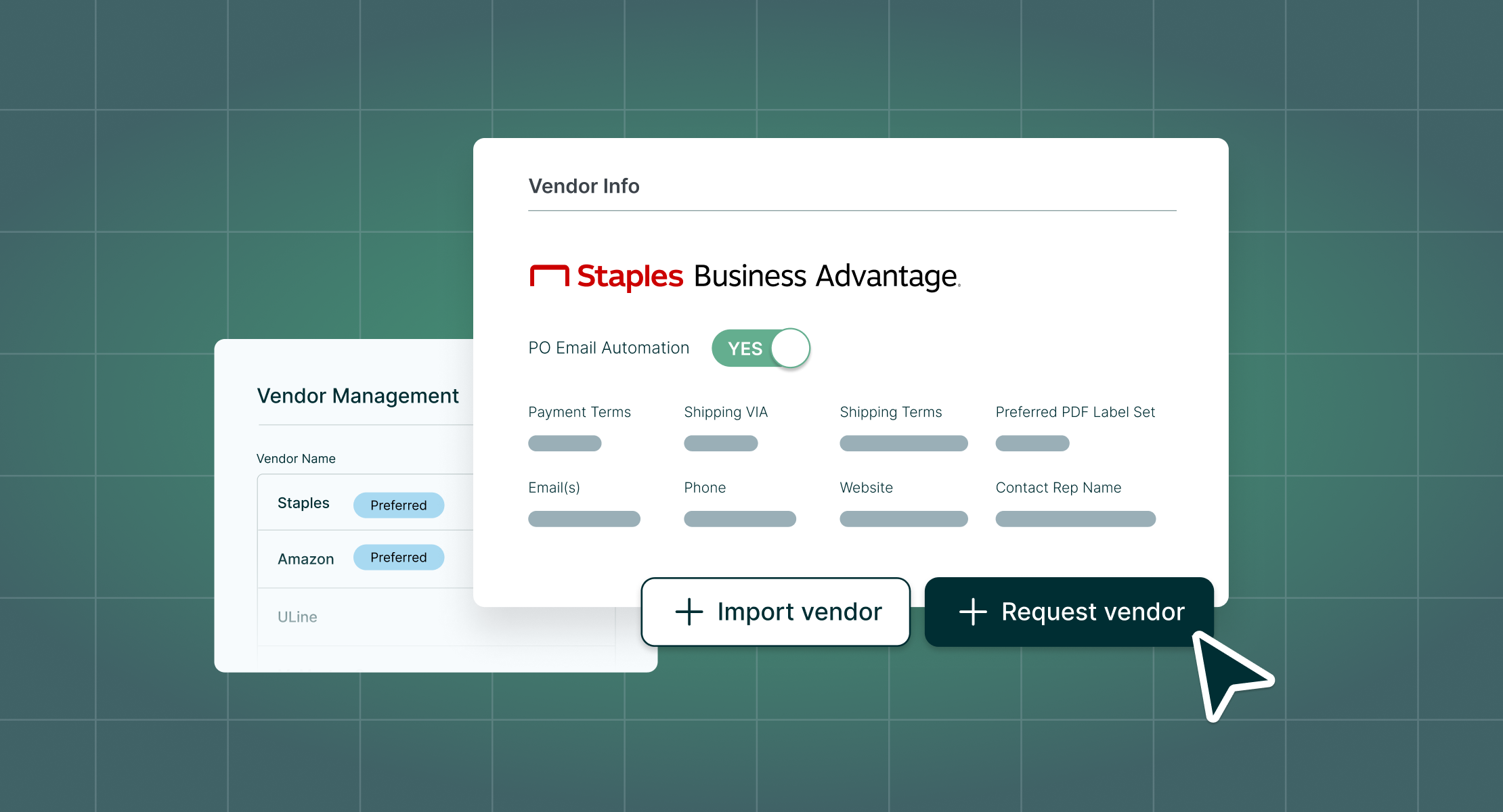

Tired of chasing supplier docs, rework, or late payments? This guide breaks down how smart teams are cutting vendor chaos and building scalable processes, without a massive system overhaul.

Procurement analytics helps finance and operations teams track spend, uncover savings, and make smarter decisions. Learn how to build a strategy that drives real impact across your organization.

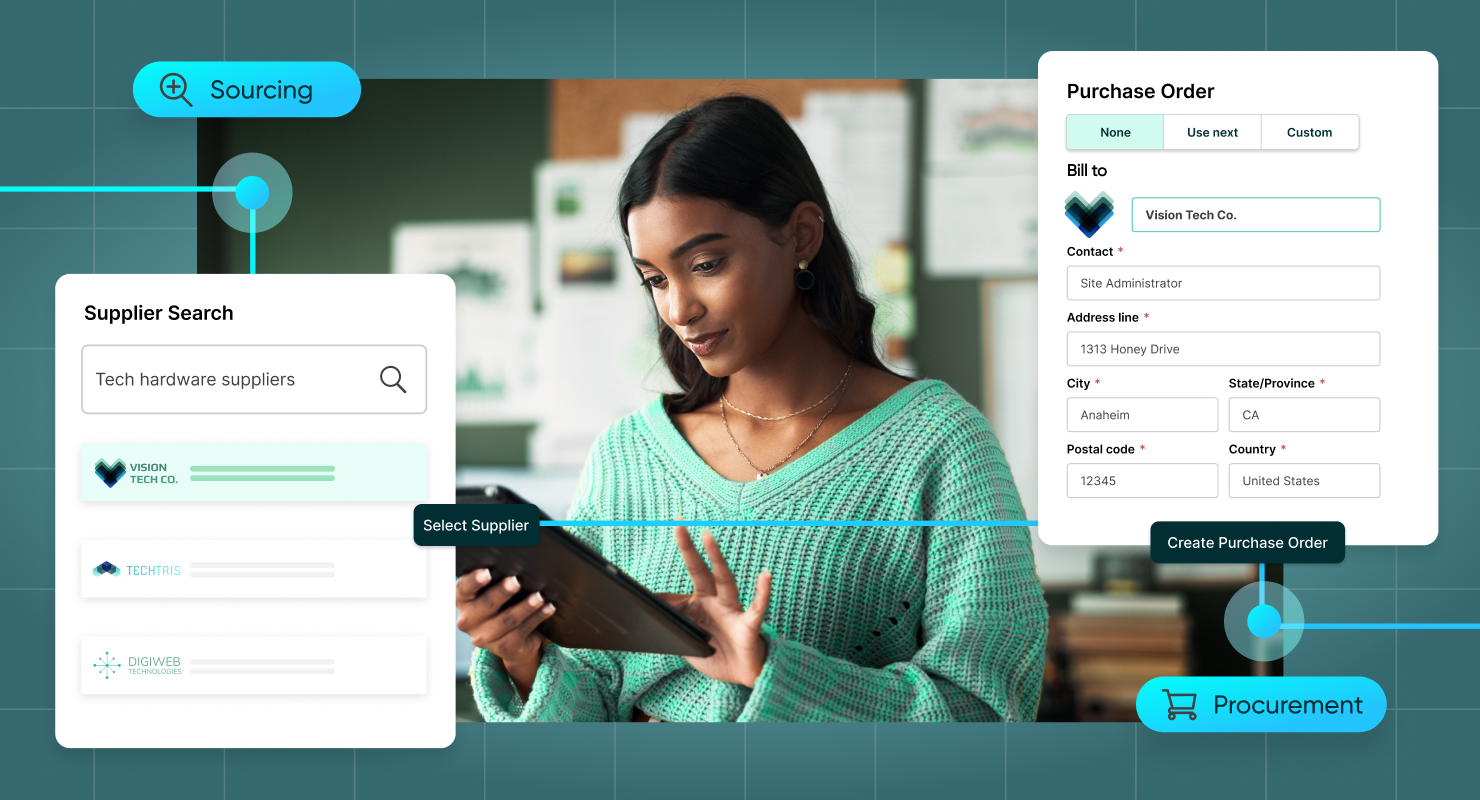

Stop treating sourcing and procurement as the same thing. Knowing the difference helps you build better supplier relationships, control spend, and optimize your procurement process.

Source-to-pay (S2P) unifies sourcing, contract management, purchasing, and payments into one streamlined process. Learn how S2P boosts visibility, reduces risk, and helps finance and procurement teams drive smarter, more strategic spending.

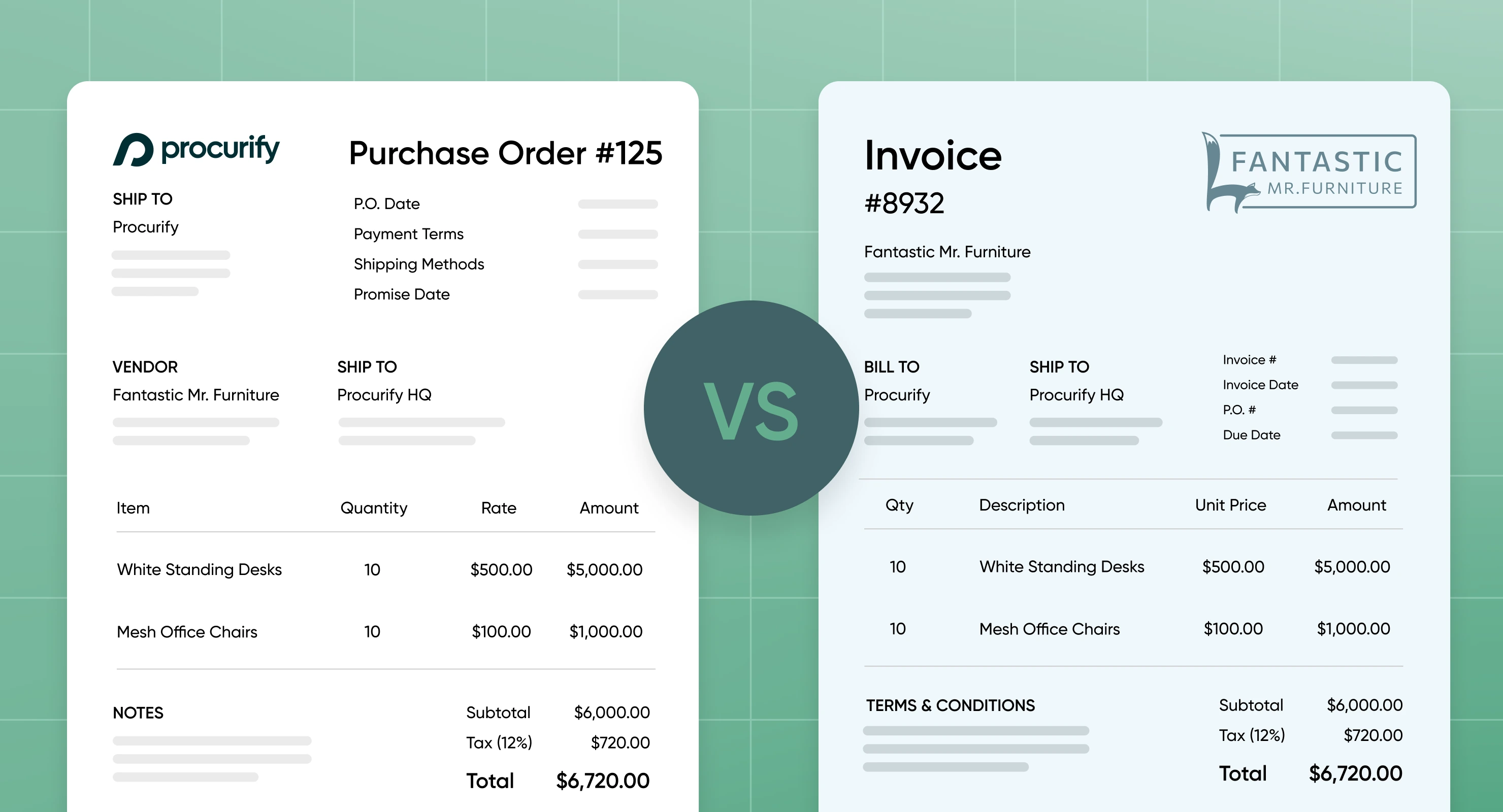

Purchase orders and invoices play distinct roles in business transactions. POs track orders before payment, while invoices ensure sellers get paid. Learn their key differences and how they improve financial control, compliance, and cash flow management.

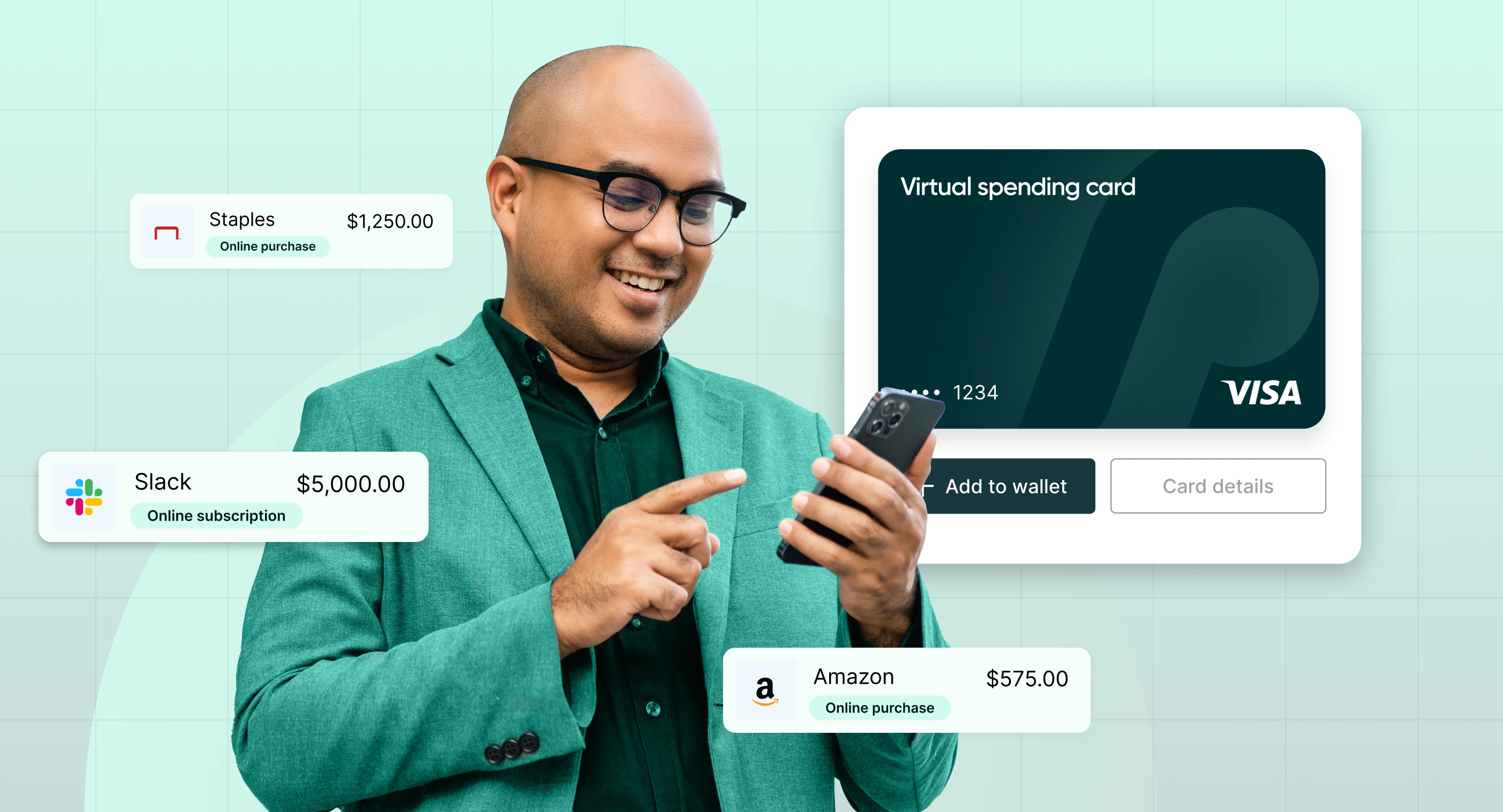

Struggling with expense tracking and budget control? Business expense cards offer real-time spend visibility, automated reconciliation, and fraud prevention. Learn how they work and why Procurify Spending Cards are the smarter choice.

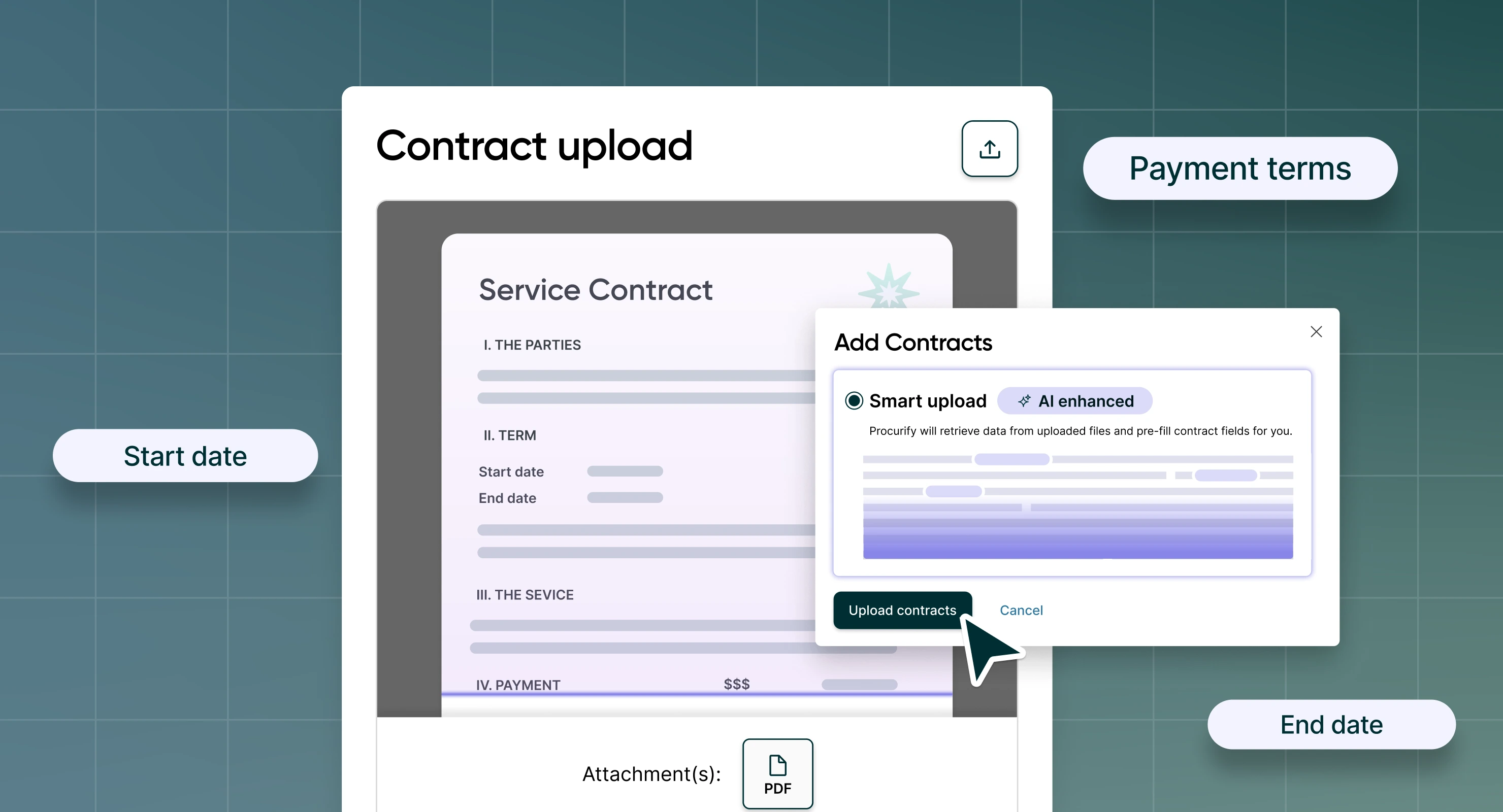

Procurement contract management software centralizes vendor agreements, automates compliance, and connects contract terms to procurement and finance workflows. Discover how it ensures cost control and risk mitigation.

Virtual debit cards give mid-market companies better control over spending, reduce fraud risks, and streamline procurement. Learn how they improve financial oversight and efficiency.

Invoice OCR transforms AP efficiency by automating data extraction, reducing errors, and speeding up invoice processing. Learn how mid-market businesses can integrate OCR for smarter financial workflows.

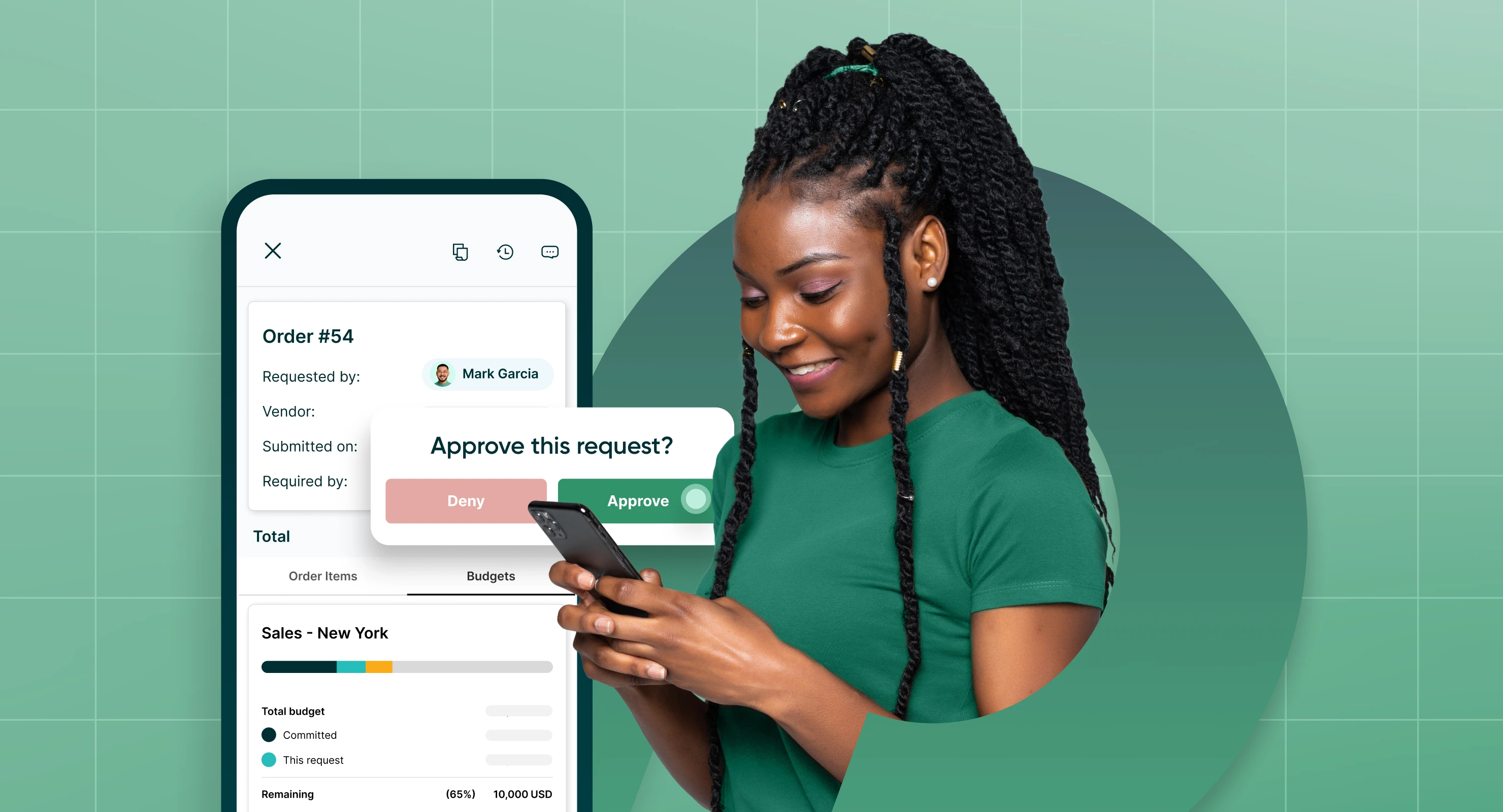

Mobile spend management gives finance teams real-time visibility and control over spending. Learn how mobile solutions streamline procurement, accelerate approvals, and improve financial accuracy—anytime, anywhere.