The 4 KPIs Your Accounts Payable Team Should Be Tracking Immediately

An Interview With Rachele Collins, SPHR, SHRM-CP, Ph.D – Principal Research Lead, Financial Management, APQC

The understanding and monitoring of the various aspects of financial processes play crucial roles in the stability, sustainability, and growth of a business. We recently released our KPIs to measure for procurement, and due to popular demand, we decided to follow up with another list.

There are certain high-level Key Performance Indicators (KPIs) that finance managers should be tracking if they want to stay on top of their games. This observation should be done regularly to avoid situations where organizations are prioritizing one KPI over the other. For instance, if proper monitoring is not done, managers may be prioritizing a low-cost KPI to the detriment of another KPI such as high productivity.

Our team at Procurify is proud to chat with another member of the APQC team – Rachele Collins, our partner responsible for financial management research at APQC, and we were able to pick useful tips from her wealth of knowledge in years of research financial management.

In this post, we will be sharing with you the 4 core KPIs she suggested that your AP team should start tracking immediately so they can be on the right page in their financial management.

According to Rachele, APQC’s recommendation suggests that organizations should ensure a balance of a certain set of KPIs for the AP process to be viable. In order to achieve this balance, finance managers must track 4 core KPIs in their AP process. These metrics are cost, productivity, efficiency, and cycle time.

The four main types of accounts payable KPIs

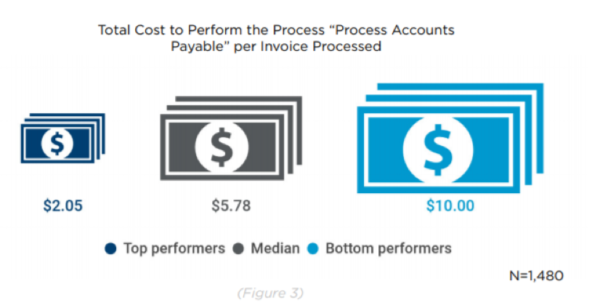

Cost KPIs

The cost KPIs measure the cost of a process standardized by factors like revenue or invoices. All things being equal, a lower number is generally better for cost KPIs.

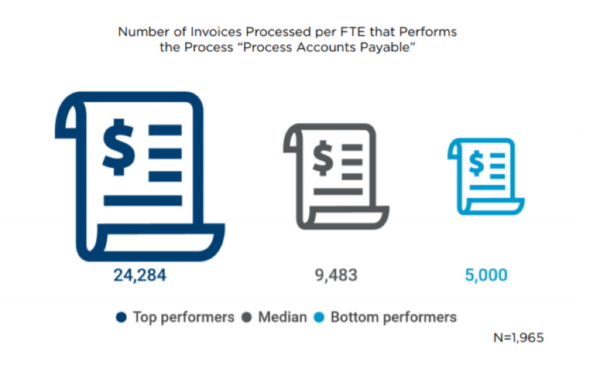

Productivity KPIs

These KPIs are meant to measure the output produced per input. In this instance, a higher number is better (again, all things being equal).

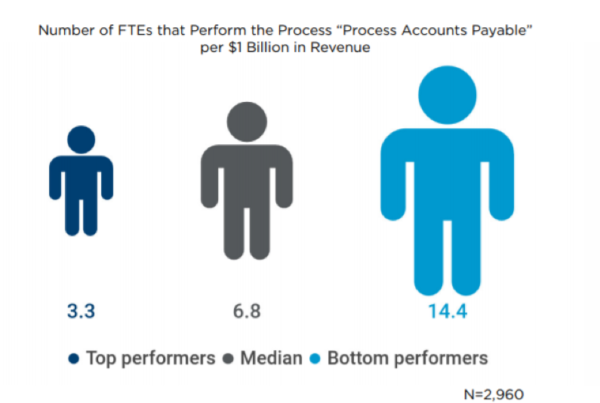

Efficiency KPIs

These KPIs are used in measuring how efficient your resources are in work performance. This measure is also standardized and is usually expressed as a percentage. Each KPI would impact the direction of efficiency metrics.

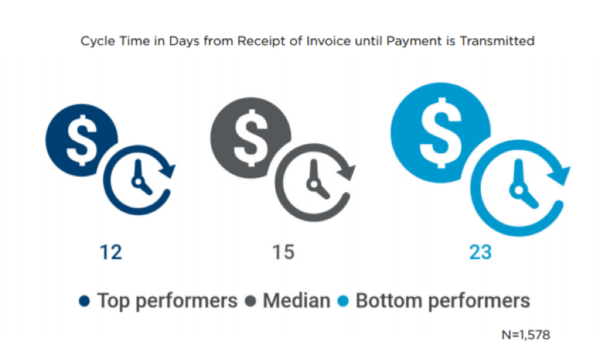

Cycle Time KPIs

These KPIs are used for measuring duration. Here, the lower or faster the results, the better for the process.

When finance managers monitor a balanced set of KPIs, they create the assurance that ascertains that one KPI is not given too much attention at the expense of the other.

The 4 KPIs your AP team should track immediately

1.Total cost to perform the AP process per invoice processed (cost)

“Once you capture all the costs that happen for AP or another finance process, regardless of where it is being performed, you may notice redundancies and opportunities to streamline, and that your process is much less cost effective and efficient than you think.”

2. Number of invoices processed per AP Full-Time Equivalent (FTE; productivity)

There is a significant difference between top performers and bottom performers for this accounts payable KPI. Many factors can affect this KPI, including automation, looking at bottlenecks within your organization, and shifting away from manual and traditional processes.

“A failure to not only understand the process, but where that process fits in the entire value chain (SIPOC) – thinking about inputs, process, and outputs from an E2E standpoint may point out additional opportunities for improvement, as often times processes fail at the handoffs (unclear roles, responsibilities, etc.)”

3. Number of AP FTEs per $1 billion in revenue (efficiency)

There is a big difference once again within this KPI between top performers and bottom performers, with a discrepancy of almost 80%. With the right processes and tools to support a new workflow, organizations can improve this KPI by a significant amount.

Being organizationally aware of its Spend Culture could align teams and employees, to ensure standardization of workflows that will increase the efficiency and performance of the AP function holistically.

4. Cycle time in days from receipt of invoice until payment is transmitted.

“Organizations should supplement these core KPIs with additional measures such as quality/error rates and stakeholder satisfaction that pinpoint their improvement concerns.”

Implementing accounts payable KPIs

Rachele recommends that every organization should supplement these 4 high-level KPIs with additional measures such as quality or error rates as well as stakeholder satisfaction. By doing this, they will be able to pinpoint their improvement concerns. This will help organizations to improve and drive sustainable growth.

“There is no quick “fix” for finance, even outsourcing parts of finance tends involves oversight and managing that relationship and quality/service levels.”

New systems and technology are important to the accomplishment of the AP process, so also is management and practices standardizing.

“Organizations interested in really improving their AP process should adopt systematic and holistic approaches when dealing with functions from structure, process, people, and technology.”

In addition, they should measure perspective and benchmark themselves both within and outside of their industry to see different possibilities about inputs, process, and outputs.

The future of accounts payable

“Organizations will focus on automating routine, recurring tasks, and leave the work for humans to what is their comparative advantage, which would be activities like customer service, exceptions, analysis, process improvement, and decision support.”

According to APQC, only 14% of all organizations have managed to implement accounts payable automation processes – which leaves a huge opportunity for organizations to rethink their processes and increase efficiency.

Get In Touch With Rachele:

We’re very lucky to have Rachele as a guest and contributor on Spend Culture.

For any follow-up questions for Rachele or if you’d like to connect with her on social media:

- Email: [email protected]

- LinkedIn: Rachele Collins

- Website: www.apqc.org/